INTERNATIONAL EMPLOYEE BENEFIT TRUSTS UK Tax Court Ruling Chaos

International employers use EBTs to reward employees. The tax treatment on both sides of the pond used to be clear and broadly in harmony.

US CLARITY

Thanks for reading! Subscribe for free to receive new posts and support my work.

In the US, we have long-standing rules on the taxation of Nonexempt employees’ trust: §§ 1.401 and 1.402

IRS Rules On Tax Consequences Of Employer Contributions To Nonexempt Employees' Trust

Essentially: Employer contributions to an EBT may be deductible for corporation tax purposes if they are paid out as qualifying benefits within a specific timeframe and are revenue-based and solely for the company's trade. If the EBT is not tax-exempt, employer contributions are generally included in the employee's gross income when they become transferable or are no longer subject to a substantial risk of forfeiture.

UK CHAOS

In the UK, it is a very different story.

The UK rules used to follow ours: employer deduction when trust pays out to employees – tax neutral in the meantime.

That’s still how it is with non-loan money, like fiduciary transfers.

But with loans, somehow, the UK tax authority (HMRC) has gotten itself into a situation where:

· No tax deduction for payments into the EBT

· Income tax (payable by employer) even though the money received is as loan and so still subject to a substantial risk of forfeiture.

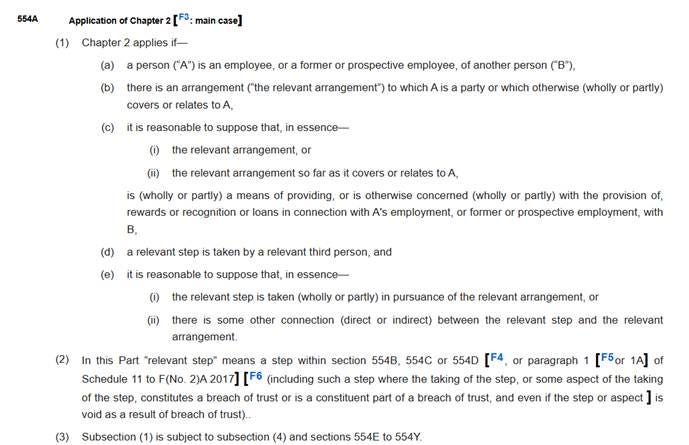

The Statute: Finance Act 2011

The story starts with this legislation which introduced what is known as “Part 7A” into the British tax code.

https://www.legislation.gov.uk/ukpga/2003/1/part/7A

What Does the Statute Mean?

14 years on, far from any certainty about what this all means, the British Court of Appeal has basically said that it means exactly: whatever it means on an objective assessment.

The case is Marlborough DP Limited v Commissioners for HMRC Neutral Citation Number[2025] EWCA Civ 796

https://caselaw.nationalarchives.gov.uk/ewca/civ/2025/796?query=marlborough

4. The first main issue on this appeal concerns the interpretation of the phrase “in connection with … employment” in section 554A(1)(c) of the Income Tax (Earnings and Pensions) Act 2003 (“ITEPA”), which is in Part 7A of ITEPA, which was introduced by the Finance Act 2011. The other main issue, which arises in the alternative, concerns the deductibility of certain expenses for the purpose of corporation tax on the ground that they were incurred “wholly and exclusively” for the purposes of the trade of MDPL.

50. Furthermore, other parts of the statutory wording which set out the context in which the phrase “in connection with” appears need to be carefully considered and applied. They impose a number of different, cumulative requirements and are objective conditions which must be satisfied before the charging provision in Part 7A can apply. For example, section 554A in more than one place uses the phrase “reasonable to suppose”, in other words it does not actually require a certain state of affairs to exist but nor is it sufficient that HMRC subjectively consider that it exists: the legislation requires that it is reasonable to suppose that that state of affairs exists. As was explained by Nugee LJ in Dolphin Drilling Ltd v HMRC [2024] EWCA Civ 1; [2024] Ch 255, at para 60, when construing the phrase “reasonable to suppose” in the context of section 356LA(3) of the Corporation Tax Act 2010, that wording “requires an objective assessment”.

This seems to say that even the UK tax authority can’t say whether it is “reasonable to suppose” that one matter is connected with another matter.

So, there is a gaping hole in the middle of this tax statute.

Widening, rather than filling that hole, the British Court said that employment does not have to be part of the reason for the payment. That mattered in this case because the recipient from the trust was a shareholder – as well as en employed director. He had gotten money thru the trust, rather than a dividend payment direct from the company. But then that could apply to American shareholder in a British employer company.

This is essentially saying that once there is money that comes thru a trust, the fact that it has come that way engages this Part 7A: it does not matter why the money was paid.

It seems that the UK tax authority is not happy with this Court ruling – and no surprise there. The Court has basically said that nobody can say when a situation is in or out of this Part 7A: until a British tax court rules on the issue.

The lesson for international companies is: stay as far away as possible from the chaos of British tax rules on EBTs.