MCANN OR MACAN’T? Troubles in the UK over their HMRC Loan Charge Scandal

Over on the UK, there is a tax policy scandal over the “Loan Charge”.

Thanks for reading! Subscribe for free to receive new posts and support my work.

https://www.computerweekly.com/feature/The-Loan-Charge-scandal-explained-Everything-you-need-to-know

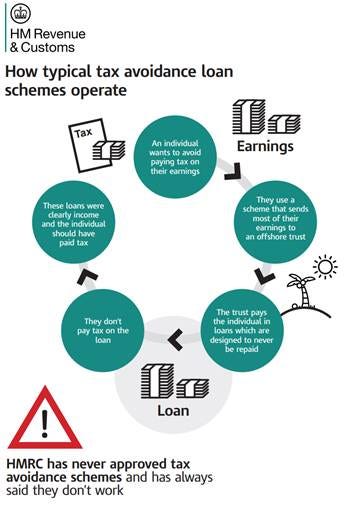

HMRC STATEMENTS

The scandal centres on the fact that the warning triangle words are not exactly representative of the truth. In fact, HMRC itself had contractors being paid through “loan schemes”.

HMRC said in 2022:

The loan charge works by adding together all outstanding loans and taxing them as income in one year. The result is that you’re likely to pay tax at higher rates than you would have at the time you were paid in loans. If you settle your tax affairs before the loan charge arises you will pay tax at the rates for the years you received the loans.

The loan charge policy is expected to protect £3.2 billion, which can be used to support our public services.

An estimated 50,000 people have used a loan scheme that will be affected by the loan charge. Most of them work in the ‘business services’ industry – this includes jobs like IT consultants, financial advisers and management consultants. Read more detail about who’s affected.

We want to make sure everybody pays their fair share of tax and contributes towards the vital public services we all use.

People who have used these schemes have a choice – they can:

· repay the original loan

· agree a settlement with HMRC

· pay the loan charge when it comes in to force

Then:

Ray McCann, former President of the Chartered Institute of Taxation, will lead the review

Review aims to bring end to the matter for people affected and is expected to conclude in summer 2025

A new independent review into the Loan Charge has today (23 January) been launched by Exchequer Secretary to the Treasury, James Murray.

Minister Murray has commissioned Ray McCann, former President of the Chartered Institute of Taxation, to lead the new independent review.

The Loan Charge, first announced in 2016, was designed to tackle historical use of contrived tax avoidance schemes that seek to avoid charges of income tax and National Insurance by disguising remuneration as a form of non-taxable payment, typically a loan.

These schemes have existed since at least the mid-1990s and have been considered by the courts. In the most notable case in 2017, the Supreme Court agreed with HMRC that schemes that redirect earnings and ultimately pay them in the form of loans do not succeed in avoiding tax.

In a further decision in 2022, the Court of Appeal confirmed that even where other parties (such as employers or agencies) have obligations to operate PAYE, the liability for income tax is that of the employee.

The government recognises the decisions of the courts and believes it is right that those who did not pay the right amount of income tax and National Insurance are required to resolve their affairs with HMRC.

However, there remain ongoing concerns about the Loan Charge, including the size of liabilities owed by some of those affected and their ability to pay the tax that they owe in a reasonable timeframe.

The new independent review aims to bring the matter to a close for those affected while ensuring fairness for all taxpayers and that appropriate support is in place for those subject to the Loan Charge. Ray McCann will review the barriers preventing those subject to the Loan Charge from reaching resolution with HMRC and recommend ways in which they can be encouraged to do so.

The government’s response to the review will be consistent with its approach to closing the tax gap and the fiscal position.

Exchequer Secretary to the Treasury, James Murray said:

Today, we honour our commitment to launch an independent review of the Loan Charge, bringing the matter to a close for those affected while maintaining fairness for all taxpayers.

Ray McCann said:

The controversy surrounding the Loan Charge has for too long acted as a barrier to bringing matters to a close for both the individuals involved and for HMRC.

I was pleased to be asked to help find ways whereby those involved can reach an agreement with HMRC that balances their right to be treated fairly with the expectation of the vast majority of taxpayers who have paid all of the tax and NIC due on their earnings. My review will be entirely directed to that end.

The review was first announced at the Autumn Budget 2024. The reviewer will present their final report to the Exchequer Secretary to the Treasury by summer 2025.

MCANNED

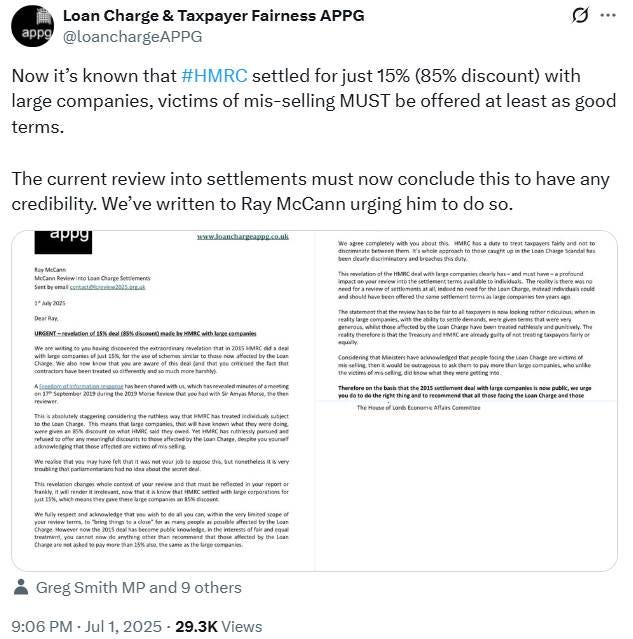

Then this happened:

https://x.com/loanchargeAPPG/status/1940094745927459159

It is also reported that Mr McCann has refused to meet with interested parties, including this group of MPs (Members of Parliament UK), to discuss this “15%” scandal.

Those affected – an estimated 75,000 British taxpayers – and 120 MPs now wait to see whether Mr McCann will actually publish a Report, or he McCan’t.