PRIVACY - PERSONAL AND FINANCIAL

As well as considering the tax implications of various jurisdictions, individuals seeking discretion when considering where to place assets will need to weigh up privacy rights in various jurisdictions.

As data protection laws have become stronger, financial secrecy has been eroded as a result of the OECD’s 2014 Common Reporting Standard (CRS). 120 countries have signed up to the CRS which requires banks and other entities to identify the residence of account holders, the beneficial owners of corporate entities and to record yearly account balances. This data is passed to local tax agencies which will report back to tax agencies where account holders or beneficial owners reside.

Thanks for reading! Subscribe for free to receive new posts and support my work.

Whenever a new bank account or financial product is taken up individuals are to self-certify their information so that institutions can collect data as required under the CRS. The information varies in some locations and may be subject to local requirements, but generally the following items will have to be declared:

- Name

- Address

- Place of birth (for Individual and Controlling Persons)

- Date of birth (for Individual and Controlling Persons)

- Country(ies) and jurisdiction(s) of tax residence

- Taxpayer identification number(s)

- Place of registration/incorporation (for Entities)

- Entity Type (for Entities)

- Controlling Person Type for certain Entity Types (for Controlling Persons)

Data Protection

When it comes to personal privacy, the EU and UK have one of the strongest regimes. The General Data Protection Regulation (GDPR) grants individuals broad rights to access, erasure and objection and imposes heavy fines for non-compliance.

Australia’s Privacy Act 1988 and the Australian Privacy Principles offer similar protection to the GDPR but allows implied consent and – for now – does not have such severe penalties.

Adequate, but less robust is Canada’s system based on notice and consent. The framework does not have the same level of transparency for individuals as the GDPR.

The USA lacks a general data privacy law. It uses sector-specific statutes for health, credit etc and there are various state laws which supplement these depending on the region.

Japan’s amended Act on the Protection of Personal Information strengthens privacy, especially for cross-border data transfers, though these are not as comprehensive as GDPR.

Financial Confidentiality

When it comes to financial confidentiality Switzerland remains one of the top jurisdictions for banking secrecy backed with criminal penalties for unauthorized disclosure.

Liechtenstein also offers robust privacy via foundations and trusts, with constitutional guarantees and limited data-sharing unless compelled by treaty

In Singapore, banking secrecy is usually upheld unless criminally compelled and it offers strong asset protection structures via trusts and foundations

UAE banks are bound by strict confidentiality laws again with minimal disclosure to foreign authorities unless legally compelled. There is no requirement for residents to report foreign assets or accounts offer a very attractive mix of privacy and tax neutrality.

Panama has strong data privacy law. Belize has confidential banking for smaller portfolios

Who Offers the “Best” Privacy?

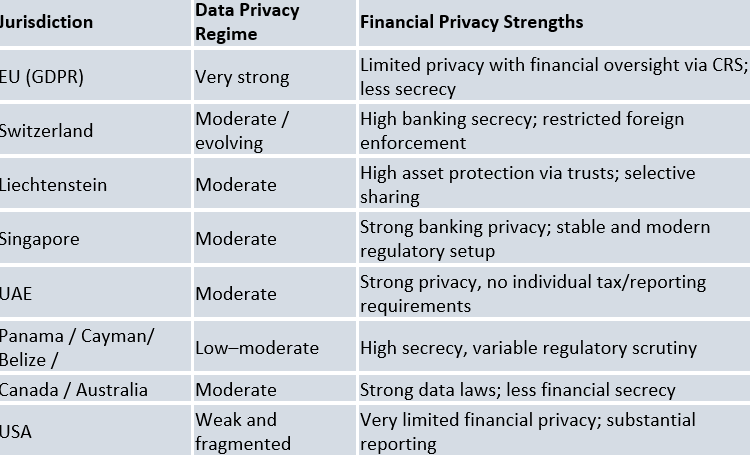

If someone seeks maximum data rights and oversight over personal information, the EU is optimal. But for those whose priority is financial confidentiality and minimal visibility, traditional financial secrecy jurisdictions such as Switzerland, Liechtenstein, Panama, Cayman Islands, and increasingly UAE or Singapore are stronger, each with unique benefits depending on tax, regulatory appetite and lifestyle.

- For digital privacy and data rights, the EU (GDPR) remains the gold standard with the most advanced individual control and legal safeguards.

- For financial privacy, traditional havens like Switzerland, Liechtenstein, Panama, and the Cayman Islands still lead—especially for high-net-worth individuals and asset protection.

- UAE currently offers a unique mix: robust legal confidentiality, tax neutrality, and controlled compliance with CRS

- Singapore blends innovation, legal clarity, and confidentiality.

- Jurisdictions like Canada, Australia, and Japan provide reliable data protection but their financial systems are transparent and regulated, limiting true secrecy.

Here’s how top jurisdictions compare:

The locations that have the strongest data protection regimes will be highly incentivised to invest in the strongest cyber security: the threat of substantial financial sanctions should certainly encourage the scrapping of any vulnerable, out of date infrastructure.