THE UK’S PENSION DEATH TAX Behavioural changes to death tax policy

OLD RULES

The UK runs a death tax (Inheritance Tax: IHT). Under the old rules:

Thanks for reading! Subscribe for free to receive new posts and support my work.

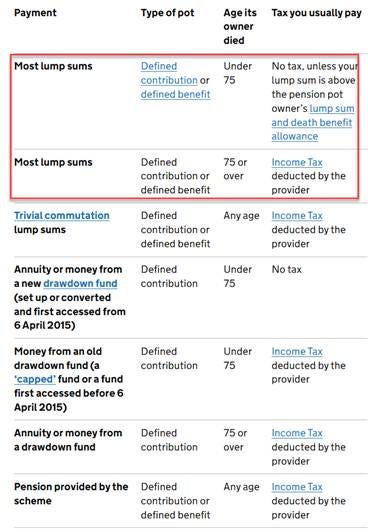

https://www.gov.uk/tax-on-pension-death-benefits

The Red Box marks where the change last Fall happened. The UK’s Chancellor (Finance Minister) announced in October 2024 that the death tax (IHT) exemption for pension pots would be removed. The UK’s Income Tax charge for draw down of pots belonging to pensioners who die over age 75 remains.

So a double tax hit of up to 67% on lifetime pension savings.

BEHAVIORAL CHANGES

The UK Treasury (Finance Ministry) has been criticized over other big tax changes for failing to anticipate behavioral changes to tax policy shifts.

There is a growing literature on this topic. The following Articles direct to useful citations and include interesting analytic ideas:

https://taxfoundation.org/taxedu/primers/primer-the-weird-way-taxes-impact-behavior/

https://www.sciencedirect.com/science/article/pii/S0047272722000937

https://www.nber.org/system/files/working_papers/w15328/w15328.pdf

Maybe a prime example of behavioral change is what happened in the UK pensions landscape after Fall 2024:

Under the UK pensions tax system, apparently 25% of this “draw down” money is free of all immediate taxes. The remaining 75% pays UK income tax (rates are 20% to 45%).

That money has gone into the death tax ‘estate’ of the individual. Thru that estate, there is 40% death tax to pay - unless that money is being given way: as to which see below.

Govt. UK has lost its grip on GDP£5 billion of “pension pot”money: by imposing a nex tax on pension pots. That is primary behavioral change to tax policy.

NUTS AND BOLTS

The draft legislation was announced in July 2025:

Eleanor Evans TEP of Hugh James summarizes the death tax (IHT) changes (July 29, 2025)

https://www.hughjames.com/blog/draft-finance-bill-legislation-published/

Key takeaways:

- From 6 April 2027, most unused pension funds and lump sum death benefits will form part of a deceased person’s estate for IHT.

- The reform is intended to change the approach often used under the current rules where affluent individuals use pensions as an IHT planning mechanism to pass on wealth free of tax, rather than the pension being used to fund retirement.

- Transfers of unused pension funds and lump sum death benefits to a surviving spouse or civil partner, or to charities, will remain exempt from IHT. Transfers to other beneficiaries will be subject to IHT at 40% on amounts above the IHT nil-rate band (currently £325,000 per person), which will be shared between the pension fund, the estate in the deceased individual’s sole name, and any trust assets in which the individual had a life interest.

- Death-in-service lump sum benefits and dependants’ pensions from defined benefit pension schemes will be excluded from the new rules.

- Responsibility for valuing, reporting and paying IHT on relevant pension assets will rest with personal representatives of estates. Pension scheme administrators will not be required to report or account for IHT (as had originally been envisaged) but there will be a scheme by which IHT can be paid directly by pension scheme administrators to HM Revenue and Customs on the request of the beneficiaries.

- The deadline to pay IHT at the end of the sixth month after the month of death will not change.

- Where pension assets are inherited after the pension holder’s 75th birthday, beneficiaries may be subject to both IHT and income tax, resulting in a potential tax burden of up to 67% of the fund being paid in tax.

- An estimated 10,500 estates will become newly liable to IHT under these changes, with approximately 38,500 estates expected to pay more IHT, on average by up to £34,000 per affected estate.

- The reforms are projected to raise in the region of £1.5 billion per year by 2029 to 2030.

Conclusions

The policy paper and draft Finance Bill legislation provide some clarity on how the new rules are likely to work in practice.

The additional responsibility for personal representatives to report and pay IHT on pension monies which are not within the estate is likely to add complexity, cost, and time to the estate administration process. This could impact on timeframes within which beneficiaries, including charities, will receive their legacies. Personal representatives will need to ensure they take prompt advice regarding the administration of estates and their obligations, particularly in view of the six-month deadline to pay IHT.

Individuals whose estates will be brought into the IHT regime as a result of the reforms may wish to review their pension arrangements and consider taking estate planning advice to mitigate the impact of the changes.

A CAGE WITH HOLES

From the perspective of behavioral change, the UK death tax (IHT) is a good example. Under that system, an individual can give away all they have, so long as they die not more than 7 years later:

How Inheritance Tax works: thresholds, rules and allowances

https://www.gov.uk/inheritance-tax/gifts

Rules on giving gifts

Inheritance Tax may have to be paid after your death on some gifts you’ve given.

Gifts given less than 7 years before you die may be taxed depending on:

· who you give the gift to and their relationship to you

· the value of the gift

· when the gift was given

You can get professional advice from a solicitor or a tax adviser about what you can give away tax free during your lifetime.

What counts as a gift

Gifts include:

· money

· household and personal goods, for example, furniture, jewellery or antiques

· a house, land or buildings

· stocks and shares listed on the London Stock Exchange

· unlisted shares you held for less than 2 years before your death

A gift can also include any money you lose when you sell something for less than it’s worth. For example, if you sell your house to your child for less than its market value, the difference in value counts as a gift.

Anything you leave in your will does not count as a gift but is part of your estate. Your estate is all your money, property and possessions left when you die. The value of your estate will be used to work out if Inheritance Tax needs to be paid.

Who does not pay Inheritance Tax

Some gifts are exempt from Inheritance Tax.

There’s no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime, as long as they:

· live in the UK permanently

· are legally married or in a civil partnership with you

There’s also no Inheritance Tax to pay on any gifts you give to charities or political parties.

The 7 year rule

No tax is due on any gifts you give if you live for 7 years after giving them - unless the gift is part of a trust. This is known as the 7 year rule.

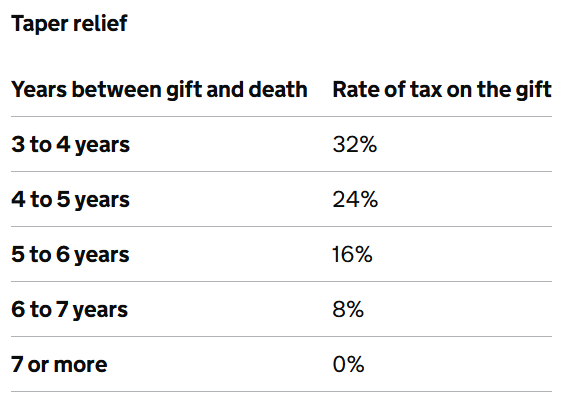

If you die within 7 years of giving a gift and there’s Inheritance Tax to pay on it, the amount of tax due after your death depends on when you gave it.

Gifts given in the 3 years before your death are taxed at 40%.

Gifts given 3 to 7 years before your death are taxed on a sliding scale known as ‘taper relief’.

Taper relief only applies if the total value of gifts made in the 7 years before you die is over the £325,000 tax-free threshold.

Giving gifts you still benefit from

If you give something away but still benefit from it (a ‘gift with reservation’), it will count towards the value of your estate.

Gifts with reservation include:

· giving your home to a relative but still living there

· giving away a caravan but still using it for free for your holidays

· giving away a valuable painting but still displaying it in your house

Read further guidance on when a gift with reservation counts towards the estate’s value.

PUSH PULL ECONOMICS

Govt. UK has created the perfect push-pull dynamic for behavioral change to tax policy.

The death tax change has overnight reduced the value of pension savings by 40%. Those are savings for this and the next generation. The previously tax free inheritance could have been used by the next generation for their starter home, college loans pay-offs and so on. Now, 40% of it will not be there.

Inevitably, the gap will have to be filled by extra household borrowing. The necessary effect of that borrowing – an obvious behavioral consequence – reduces the death tax fiscal base.

Example:

· Pensioner age 65 has a $100,000 pension pot.

· That will suffer 40% ($40,000) on his death.

· Pensioner borrows $100,000, jointly with his wife.

· They gift that money to the children under the 7 year rule: no death tax (IHT).

· So, even when the pension pot is included in the death estate, the net value in the estate is $zero.

The kids can then repay the $100,000 loan out of the pension pot which has been passed onto them tax free. In the meantime, there is a mutual set-off on the interest rates of the money lent and the money on deposit: assuming the kids do not spend the money meanwhile.

In the US:

Where you can move value from a taxed terrain to an untaxed terrain with no friction except mutual set-off borrowing costs, you do not really need a dynamic scoring model. Basic behavioral economics dictates the movement.

What is interesting is how the UK is providing a laboratory study in how rational behavioral responses have produced a flight of current money into income taxed draw downs as against the certainty of future death tax, as the UK’s Daily Telegraph has reported.

Either way, Govt UK has a pressing need to improve its dynamic modeling for behavioral change to death tax policy.