US GOLD REVALUATION?

Forbes reports:

The Treasury Is Sitting On A $750 Billion Gold Hoard Officially Valued At $11 Billion

Thanks for reading! Subscribe for free to receive new posts and support my work.

Soaring gold prices and a $37 trillion national debt have revived debate over revaluing gold reserves. A new Federal Reserve note explores how other nations raised funds through revaluation.

Aug 06, 2025, 03:22pm EDTUpdated Aug 6, 2025, 03:48pm EDT

Revaluing Fort Knox's gold to fund a strategic bitcoin reserve or pay down the national debt is no longer unthinkable.

Gold is up more than 40% in the past year, from under $2,400 an ounce to over $3,400. Meanwhile, the national debt is approaching $37 trillion.

That’s helped revive an idea long dismissed as fringe: revaluing the government’s gold reserves to raise cash. It sounds far-fetched. But a new research note from the Federal Reserve suggests it may not be as out there as it seems.

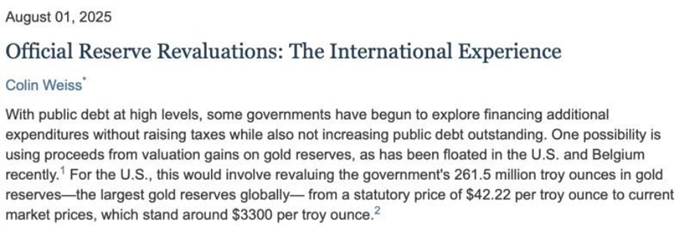

On August 1, the Federal Reserve published a research note called “Official Reserve Revaluations: The International Experience.” It outlines how five countries used gains on their official gold holdings to raise funds. It does not propose the U.S. do the same, but it explains the steps involved and what to expect if it happens.

The note covers Germany, Italy, Lebanon, Curacao and Saint Martin, and South Africa. Some used revaluation proceeds to reduce debt. Others used them to cover central bank losses. The examples are limited but show how governments have tapped into hidden value without raising taxes or issuing new bonds.

The U.S. Treasury values its gold at $42.22 an ounce, a price set in 1973. It holds 261.5 million ounces, the majority of it at Fort Knox in Kentucky. At the official price, the gold is worth $11 billion. At today’s market price, it would be worth more than $750 billion. Revaluation would not require selling the gold. It would simply update its book value.

The Treasury could adjust the value of U.S. gold reserves through a few bookkeeping steps. It might retire its current $11 billion gold certificate (issued by the Treasury) and establish a higher official price for gold (which could be lower or even higher than the market price). Next, it could "transfer" the gold to the Fed at this new price, potentially gaining billions or trillions (remember, it need not revalue the gold to the current market price). The Fed would then return the gold to the Treasury for a new certificate. No gold physically moves, but the Treasury ends up with a significant amount of newly created funds.

What would happen next depends on policy decisions.

The cash infusion from the revalued gold could be used to pay down debt or finance new spending. A footnote in the Fed paper notes that recent U.S. legislation proposed by Wyoming Senator Cynthia Lummis (a Republican and crypto champion) contemplates using revaluation proceeds to create a sovereign wealth fund or a strategic bitcoin reserve. (Both the sovereign wealth fund and the bitcoin reserve are ideas that President Donald Trump has talked about.)

Sounds good, but there are potential repercussions.

Crediting the Treasury with new funds increases the money supply. That could stoke inflation. Critics have described the idea as backdoor money printing or, even, as plain old “accounting manipulation.” Others point to the 1934 gold revaluation, which led to a sharp increase in the money supply. It also sidelined the Federal Reserve, giving the Treasury effective control over monetary policy until the 1951 Fed-Treasury Accord restored the central bank’s independence.

That history may be one reason the idea hasn’t moved forward. With renewed criticism of the Federal Reserve from the Trump administration, including chiding the central bank over its decision to delay interest rate cuts, any move seen as potentially undermining Fed independence could draw political fire–and a negative reaction in the markets.

That may help explain why officials have been quick to shut the door.

Treasury Secretary Scott Bessent addressed the issue earlier this year. On the All-In podcast in March, he said the Treasury is not considering revaluation. “I can say today we’re not revaluing the gold,” he declared. (The All-In podcast, hosted by investors Chamath Palihapitiya, Jason Calacanis, David Sacks and David Friedberg, is popular in business and investing circles–and among those who have Trump’s ear. Sacks, in fact, holds the title of chair of the President's Council of Advisors on Science and Technology.)

Bessent’s March disavowal of any thought of revaluation may still be the case. But the Federal Reserve publishing a note on how a revaluation has worked for others means the Overton window–that is, the realm of ideas that get seriously discussed–might have cracked open.

This takes a more pushy angles on the subject. Although the company does sell the subject-matter itself, so is not disinterested. But there is valuable detail here on the Fed’s statement:

U.S. to Revalue Its Gold Reserves

August 11, 2025

In these weekly columns, we have frequently discussed the idea that the U.S. is planning to revalue its official gold reserves. Recent news suggests that the revaluation could be coming sooner than most expect and likely in 2026.

Let's start with some background. If you're a regular visitor to Sprott Money, you'll likely recall these posts from February and March of this year. The links below offer a good refresher, regardless:

- Some Golden Speculation

- Possible Gold Price Revaluation

- Monetize The Asset Side

- Revalue Gold. Buy Bitcoin?

The most recent hubbub came from an unusual report issued two weeks ago by the U.S. Federal Reserve. Unusual in that The Palace of Fiat would even acknowledge the existence of gold as anything other than a barbarous relic. Here's a link to the brief report with the opening paragraph shown below:

Gold Price Revaluation And Bitcoin Reserve

Some have speculated that this official revaluation will be utilized to pay down and retire some of the $37T in U.S. federal debt, and maybe it will. However, far more likely is a revaluation for the purpose of funding President Trump's Sovereign Wealth and/or Bitcoin Reserve funds. Revaluing the official U.S. gold reserves from $42.22/ounce to the current market price of $3400 would "create" nearly $800B in what would be termed "debt neutral" cash, and that $800B would be used to finance Trump's funds.

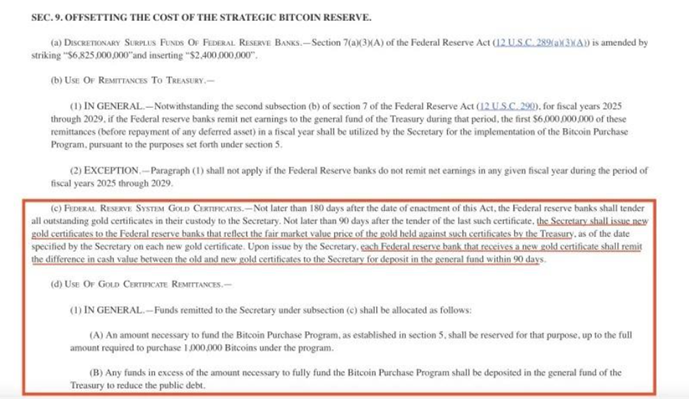

Think that's crazy? You're sorely mistaken. In fact, pending Congressional legislation regarding the creation of a "National Bitcoin Reserve" openly states that the cash to be utilized for acquiring the Bitcoin will come from a revaluation of the U.S. gold reserves. It's right there in the bills! See for yourself!

How To Buy Gold And Silver Before Revaluation

Both bills will be debated and, if moved forward, will be voted upon, reconciled, voted upon again, and then sent to President Trump for his signature. This is a long process and one that is likely to carry over into 2026 before final passage. But it's what President Trump wants, and as we learned with the debt-laden "Big Beautiful Bill", what the President wants, he often gets.

From where will the funds come in order to buy the national Bitcoin? You can find it right there, plain as day, in the language of the bill. See below:

And just to make sure that all the I’s are dotted and T’s crossed, the bills even codify and redefine the value of gold from the ancient but current $42.22/ounce. See this:

31 U.S. Code § 5117 - Transferring gold and gold certificates

In the end, connecting all the dots for this picture is about as simple as a children's workbook. The politicians are warning you that an official gold revaluation is coming, and the price action since Trump was elected is telling the same story. The only question: What becomes of the market price for gold when this official revaluation happens?

No one knows. Seriously. How could anyone be certain as no one alive today has lived through an official U.S. government revaluation. If the U.S. just simply uses the London PM Fix of, say June 15, 2026, what does that mean for price on June 16? Probably nothing. HOWEVER, it speaks volumes regarding the value of gold as something other than a barbarous relic. Additionally, other central banks and governments around the world may follow suit and issue their own official revaluations.

Beyond that, the simple inflationary impact of the sudden creation via accounting gimmick of maybe $1T in new fiat would be significant. A new form of QE, in a way. And as governments around the world race to devalue their currency toward zero, physical gold shines even brighter.

So we'll keep track of this story as 2025 continues. Nothing is certain, of course, and politics can be an ugly and messy business. The signs are clear, though, for anyone willing to notice. An official revaluation of the U.S. gold reserves is coming. Prepare accordingly.

The mere fact that the Fed is opening the Overton Window on this adds serious fuel to the fire of speculation that the post-Bretton Woods fiat currency regime is – if not dead – then on life support.